July 4

Gold stagnates as oil brightens in mixed commodity outlook

Different commodities have experienced mixed fortunes since the start of the year. Oil suffered sharp declines as inventories climbed earlier in the year while concerns over China’s growth triggered a correction in bulk metals. On the other hand, gold rallied on the back of heightened political uncertainties. Some of these movements are expected to reverse in the second half of the year. Citi analysts see oil prices heading higher as the output cuts since January start to tighten supply. In contrast, the upside for gold seems limited.

Oil: Supply is Tightening

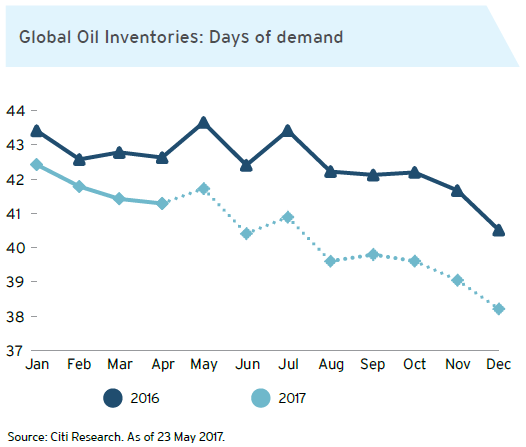

- The decision by OPEC (Organisation of the Oil Producing Countries) to extend output cuts on 24 May by another 9 months disappointed investors. Nevertheless, Citi analysts believe that oil supply is tightening as the impact of the output cuts since January starts to kick in. See Figure. Quarter to date as of late May, Citi analysts estimate that oil inventory has fallen by 0.6 million barrels/day. This contrasts with the average rise of 0.64 million barrels/day seen historically for the same period. Citi analysts expect oil inventory to continue to fall in the second half of 2017, as demand for oil rises with the end of the refining maintenance season.

- Oil demand may surprise on the upside given Citi’s positive global growth outlook. Supportive demand and supply factors can push Brent prices to US$60-65/bbl. Citi analysts forecast WTI to end the year around US$62/bbl. There is a risk that these price forecasts may not be reached if US, Libya and Nigeria produce more oil than expected. On the other hand, with global oil supply disruptions at a five year low, more outages cannot be ruled out.

Copper: Heading Higher

- Metal prices sold off in May on concerns of delays to Trump’s economic agenda and ambitious infrastructure spending plan. Investors were also worried about Chinese demand for metals after the local government recently tightened measures to target speculators in China’s property market. Citi analysts remain cautiously optimistic on the outlook for copper, expecting mine output to fall by 1.5% in 2017, the first year of falling supply since 2002. Tighter copper supply and stable global demand are expected to push copper prices above US$6000/t.

Gold: Price Has Peaked

- Gold prices rose 10% for the year up to end May helped by a softer USD and investor expectations that the Federal Reserve would only hike rates very gradually. Investor interest in the precious metal was also boosted by uncertainty over US domestic policy as well as by heightened geopolitical risks particularly in the Middle East and North Korea. Citi analysts believe that gold prices have probably peaked in the second quarter. It would likely require a significant deterioration in the US political and economic situation for gold prices to move higher. With Citi expecting a total of three Fed rate hikes in 2017 and higher US long term bond yields at the end of the year, the upside for gold is likely to be limited although prices are expected to be supported around US$1200/oz.

Iron Ore: Excess Supply

- Iron ore prices tumbled from a high of US$95/tonne in February to US$60/tonne as of end May, reflecting the mounting inventory of lower grade iron ore at China’s ports. If China cuts its steel capacity more quickly in the third quarter of 2017, this could support steel prices and in turn, iron ore prices in the near term. Over the medium to long term, Citi analysts remain bearish on iron ore and expect excess supply to cause prices to average US$53/tonne in 2018. This will have important implications for the AUD with iron ore being a key Australian export.

Take your next step with Citigold

Key Takeaways

- Tightening supply and a positive outlook for global growth can push Brent prices to US$60-65/bbl.

- Gold prices have probably peaked in the second quarter and would require a significant deterioration in the US political and economic situation to move higher.

- Excess supply may keep iron ore prices low, potentially having negative implications for the AUD.

Note: The Federal Budget is not set in stone, and could change as legislation passes through parliament.

Any advice is general advice only. This document was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it's suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Investment products are not available to US people and may not be available in all jurisdictions. This material is taken from sources which are believed to be accurate, however Citibank accepts no liability of any kind to any person who relies on the information in it.

© 2019 Citigroup Pty Limited. All rights reserved. ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.