June 2017

Tremors shake property confidence

By Chuck Chu

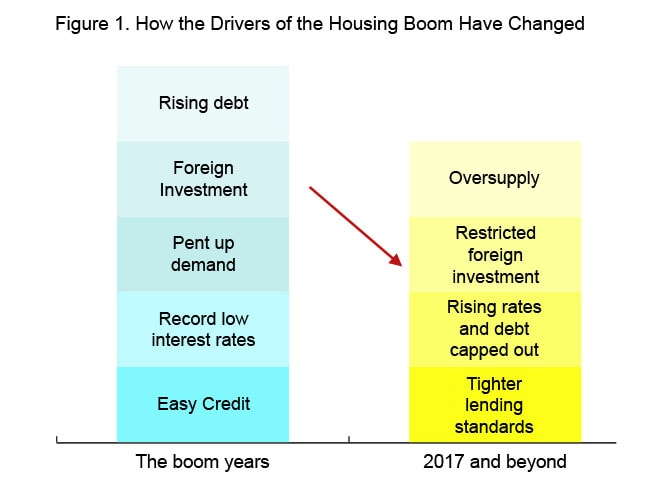

A five-year long surge of activity in the Australian property sector has led the charge to help transition the economy down off the mining boom. The problem is the housing boom is petering out before the transition is complete, and it is causing regulators like the Reserve Bank of Australia (RBA) some consternation.

Wind-back 12 months and the regulators, including the RBA, Australian Prudential Regulatory Authority (APRA) and Australian Securities and Investment Commission (ASIC) were clearly starting to make it harder for foreign investors to enter the local property market to take pressure of rapidly escalating prices.

That clampdown really took effect from about the start of the year, so that now foreign buyers only account for about 5 per cent of investment properties bought compared to 15-20 per cent this time last year.

It will now be interesting to see if the regulators will keep up those restrictions on foreign investment if property prices start to fall.

The RBA and politicians made a lot of noise about the transition off the mining boom, because if it was not handled correctly it posed financial stability risk.

Research released in early May from Citi suggests the slowdown in property activity could pose even greater risk to financial stability than the mining wind-down.

The analysis also found much of the growth in wealth for Australian’s over the past three years came from housing, which makes sense as wages growth has been anemic over the period, and shows no sign of improving.

As the regulators and politicians have also stated many times, too many Australian’s are carrying too much debt, mostly associated with mortgages, so if interest rates start to increase in about 12 months’ time, as Citi analysts predict, it will compound the negatives already present in the chart below.

Source: Citi Research

Source: Citi Research

Even a mild tick up in interest rates will put a substantial further crimp in household spending, which is already low and causing a lot of trouble in other parts of the economy like the major employment industry, retail.

And it is a mild tick up we are expecting. Citi forecasts rates will start to rise mid-2018 at the earliest, and will still only be 2.5% by end 2020.

But it’s not so much that the additional costs will push a lot of families under, although the RBA has noted one-third of mortgage holders have at most one month’s buffer against economic hardship. But the more immediate result is it will further damage already timid consumer sentiment, and it won’t be fixed until solid wage pressure growth starts to materialize.

"One-third of mortgage holders have at most one month’s buffer against economic hardship."

There are enough factors at play that it raises a worst case scenario for property where some markets, and some segments like apartments, suffer significant price falls during the transition out of the housing boom.

Citi analysis expects it to drag 0.3 per cent off Gross Domestic Product (GDP) in 2018, although that does not include any spillover into the rest of the economy, but we do not expect it to lead to recession.

If that occurs, it will be interesting to see if the fear over foreign investors buying up property takes second seat to the fear over falling house prices. Particularly as it is such a mainstay of the Australian wealth story.

Chuck Chu is Citi’s senior vice president strategy & reporting.

Take your next step with Citigold

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. You should consider if this advice is appropriate for your situation. We recommend you read the Product Disclosure Statement (PDS) or Terms and Conditions, available online or via a Citibank branch, in addition to seeking independent legal, financial and taxation advice on your personal circumstances before acting on the information contained in this material.

This material is for general information only. All opinions are subject to change without notice. This material is taken from sources which are believed to be accurate; however Citibank accepts no liability of any kind to any person who relies on the information in it. Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risks, including the possible loss of the principal amount invested. Investments are subject to risk, including loss of income and principal. Past performance is not an indicator of future performance. Due to exchange rate fluctuations, you risk losing capital if you invest in foreign currency. Some products are not available to US persons and may not be available in all jurisdictions.