February 2018

2018 Global and Australian Investment Outlook

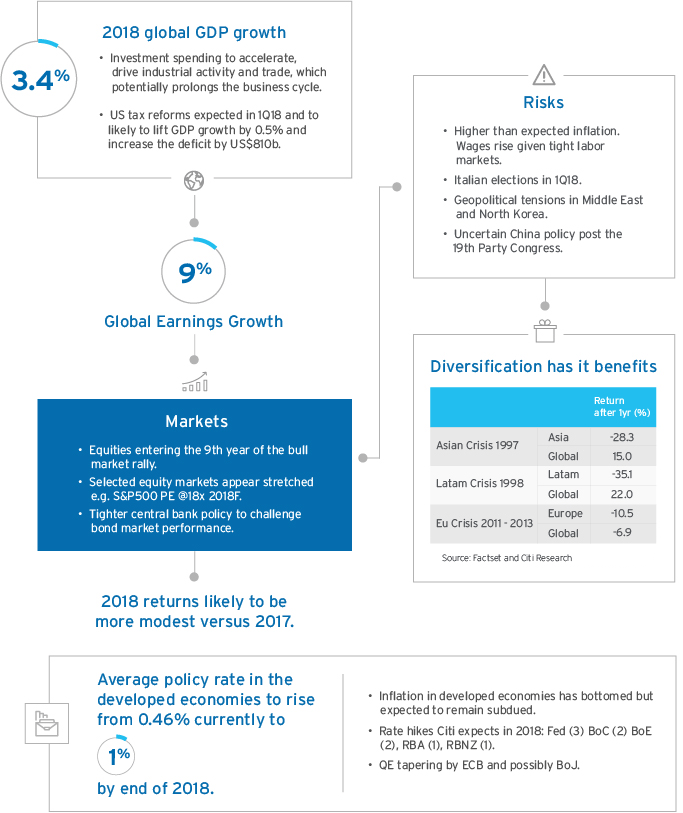

2018 Global Outlook

Healthy economic and earnings growth in 2018 indicate there will be investment opportunities in selected equity and bond markets. Returns are likely to be more modest as developed market central banks tighten monetary policy amid more expensive market valuations.

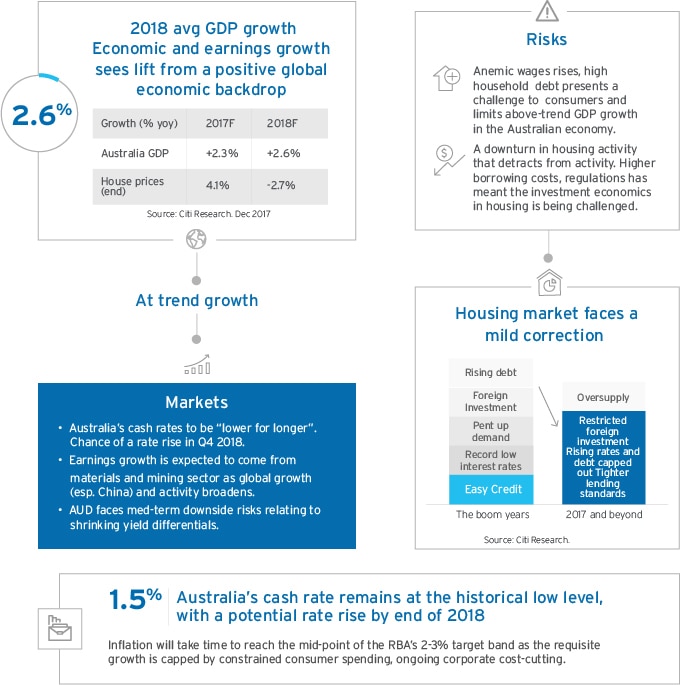

Outlook for Australia

Citi economists expect modest growth for Australia. A combination of strong public investment and net exports is constructive. However declining wages share of GDP, where highly indebted households moderates consumption remains a headwind. Upside risks are employment gains, downside risks are housing.

Investment Themes for 2018

Seek balance and diversify

Rebalance concentrated positions in your portfolio. With elevated risks, investors can benefit from well diversified portfolios.

- Consider global fixed income investments

- Consider structured products tied to multinational opportunities

- Consider currency diversification

Ride the structural trends

Big Data & Artificial Intelligence will disrupt business models but also create opportunity.

Asia markets are increasingly focused on tech and lifting earnings through efficiency gains.

- Applications like autonomous driving to high-function robots will evolve from research labs to mainstream.

- Tech now accounts for 29% of Asia index, while rate-sensitive sectors in the index has fallen from 55% to 30%.

Artificial Intelligence + Big Data

Asia

Position for rising interest rates

We expect bond yields to rise gradually this year but if inflation picks up it could quicken the pace. Look for an exposure to quality financials.

- Entry point via structured products or investment grade bonds to take advantage of improving loan books, increased lending and improved margins.

- For US Investment Grade bonds we expect spreads to tighten. We favour a US exposure to energy, financials and materials.

Financials (bonds)

US

Capitalise on low volatility to seize FX opportunities

USD to trade in tight ranges amid expected rate hikes and tax reform uncertainties. With the USD rally fading, investors can consider opportunities in commodities and other G3 currencies

(€ and ¥).

- AUD faces downside risks that include weaker iron ore prices and shrinking yield differential.

- EUR & JPY are well positioned to benefit from central bank policy tightening.

- Brexit negotiations to provide opportunities for Sterling bears as the divorce bill balloons.

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions.