December 2017

Will the Federal Reserve Quicken Rate Hikes?

By Simson Sanaphay

The newly nominated US Federal Reserve chairman Jerome Powell will likely watch with approval as incumbent chair Janet Yellen flicks the switch on yet another interest rate hike this month, as she prepares to vacate her office.

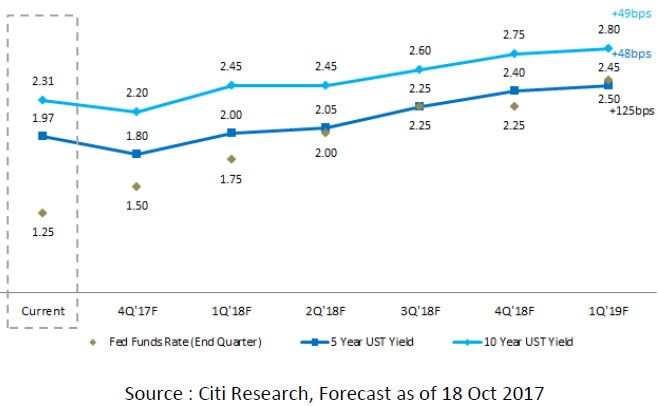

The expected rate hike will mark the third and last rise for 2017, and we are forecasting another three hikes in 2018 under Powell.

Yet we don't see it as a quickening of the Fed’s desire to return to normalised policy settings, but rather a continuation of a careful and deliberate strategy based on evolving economic data, and particularly weaker than expected inflation.

Citi was amongst the first to forecast a December hike, and we remain more aggressive than market consensus on expected hikes next year. But we are driven by our long standing belief President Trump will push through his proposed tax cuts and stimulate growth.

Given recent agreement from the Republicans and Congress on the need for tax reform legislation, we believe it could be passed as early as the first quarter of 2018.

This is based on the speed at which US debt ceiling negotiations for a three month extension were sealed. It showed a process by which the US administration and Congress can reach deals, and in our view, the probability of a fiscal package containing tax cuts and infrastructure spending in 2018 in partnership with the Democrats, has gone up.

We estimate lower tax rates on US corporates and individuals, by as much as USD$2 trillion over the next five years, cumulatively adds about three per cent to real US GDP between 2017-2021. That would energise US economic growth.

A consequence is US Treasuries (UST) beyond 12 months may increase as investors demand higher yields in anticipation of inflationary pressures from higher growth and accommodative fiscal policy.

Tax cuts also mean the government may need to borrow more to cover any shortfall in receipts to balance the budget. To attract funding it will have to offer a sufficient sweetener to the yield to attract funds away from the private sector.

On top of this, the Fed has signalled its intention to begin the process of tapering its USD$4.5 trillion balance sheet. As maturities of UST roll off potentially higher yields will be required to tempt corporate and private investors to take up the additional capacity created by the Fed’s removal from the buyer pool. However, the slow and well-telegraphed decline in the Fed’s balance sheet is not likely to induce a taper tantrum market reaction, in our view.

After nearly reaching a low of two per cent in early September, amid geo-political concerns and northern hemisphere summertime illiquidity, 10-year yields have risen since then. As we look to year-end, the direction of US rates will rest largely on any progress over US tax reform. The risk to the tail-end of the year and early into next year is for higher UST yields.

Key Takeaways

Our model suggests upward pressure on US treasury yields. However, there is potential for a dip if US tax reform takes a backward step, or if other geopolitical risks like North Kora flare up. Any dip in government bond yields would result in corporate bond yields increasing, creating an opportunity to consider switching high cash price issues with newly issued instruments that are closer to par, and provide a better yield pick-up for similar duration.

Alternatively, for clients who use government bond markets as a barometer for their equity exposures, a short term yield dip would likely coincide with lower equity prices and increased equity volatility, making a better entry point into equity exposures.

Simson is an Investment Strategist for Citi’s Wealth Management business

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions.