- Home

- |

- Investments

- |

- Investing for the long term

Why long term?

It's important to accept that stock markets will move and the value of your investment will fluctuate with them. The best you can do is manage the risks you are exposed to, which is where a longer investment period can help.

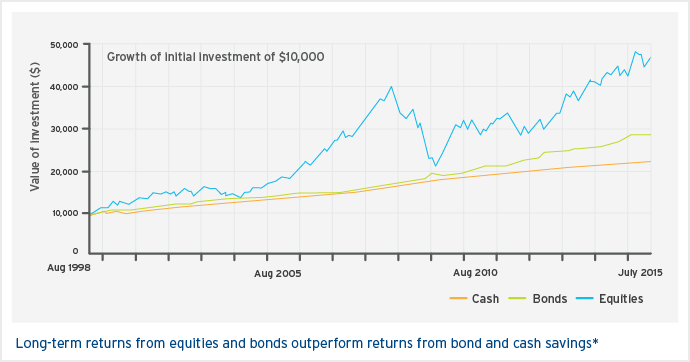

When markets have fallen significantly in the past - the global financial crisis being a recent example - we have also seen long-term investors rewarded for their patience, with the peaks and troughs of short- and medium-term market smoothing out* over longer time horizons. This applies to markets overall, and is why a diversified portfolio is important; returns from individual holdings can be influenced by many other factors, but market returns follow a common path.

If you are able to hold a quality investment for a longer period of time, you increase the likelihood of it having gained value when the time comes to sell.

What is long term?

While the optimal investment horizon varies between asset classes - and also by investments within each class - as a general rule of thumb equity investors should be looking to hold their asset for at least 5-7 years, in order to ride out any cyclical fluctuations and see the benefits of long-term investment.

The added benefit of compounding

When you invest for the long term, you have the opportunity to benefit from the compound performance of your investment. Much the same as earning compound interest on cash savings in a bank account, when investing you can reinvest the dividends you receive which will then earn you further returns. Over time, compounding can make a significant difference to the total return on your original investment, although you should be aware that reinvested income is also exposed to investment risk and so positive returns are not guaranteed.

*Graph compares the value of $10,000 saved/invested on 31.08.1998 to the value of the investment/saving on 31.07.2015, as calculated using relevant indices: the value of Savings is calculated using the Bloomberg AusBond Bank Bill Index; Bonds using the Bloomberg AusBond Composite 0+ Year Index; Equities the S&P/ASX300 Index, with returns include dividends reinvested, but excluding franking credits. Past performance is not an indicator of future performance.

Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing.

Investments are not deposits or other obligations of, guaranteed, or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions. All investments are subject to risks and can change in value.