March 2018

Federal Reserve Hikes Again as Reserve Bank Stagnates

By Simson Sanaphay

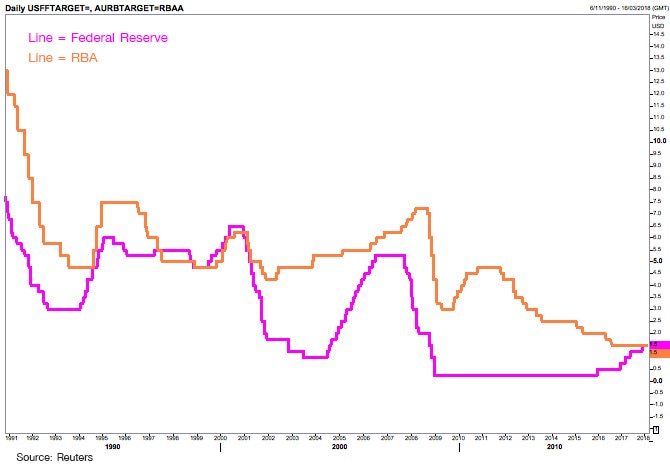

The US Federal Reserve delivered a widely anticipated rate hike last week and we think it will be the first of many for newly appointed Fed chair Jerome Powell. It is already the sixth increase since December 2015 and it will push the official US cash rate higher than the Australian Reserve Bank's.

It will be the first time "monetary policy crossover", as the market dubs it, has occurred since 1999 and is a clear signal of just how ordinary the Australian economy has become.

And there are implications for investors. In the short term we expect exchange rate differentials to maintain a leading rate for local fixed interest instruments. The same cannot be expected in the medium to long term.

That the US has been pushing rates higher for over two years is testament to the growing strength of its economy. The RBA would also like to nudge the historically low local cash rate of 1.5 percent up a few notches, but it has been restrained by the lackluster performance of the economy.

At Citi we think it is these two different economic environments that in time will transform "policy crossover" into "policy divergence" between US and Australian rates. We currently forecast two more Fed rate increases this year, with a further three rate increase in 2019. We expect the RBA to make its first increase late 2018, with the risk that this could be later rather than earlier.

1) This chart tracks the US Federal Reserve and Australian Reserve bank cash rate

And how did we get to this economic divergence? Australia had interest rate "leadership" through much of new millennium thanks to the mining and residential housing booms, which underpinned a strong and vibrant economy. It was reflected in the strength of the AUD that was highly coveted for superior interest rate differential.

But despite marking 26 years of economic expansion last quarter the RBA now stands still with its rock-bottom cash rate, patiently waiting for domestic economic gains to spill over from the world’s improved economic growth.

Making our corporate tax rate competitive could hasten the process but it’s unlikely given the government’s priority to deliver a budget surplus by 2022.

In sharp contrast, the US is expected to grow at 2.8 percent this year compared to our forecast 2.6 percent growth rate for Australia. That’s remarkable considering the US economy is about 15 times larger than the Australian economy. And it’s because it has been turbo-charged by a once in a generation cut to corporate & individual tax rates, strong corporate profitability leading to hiring and full employment, with further recent hints of wage gains. Things are looking up for the US economy, it’s no wonder the Feds look to further rate increases.

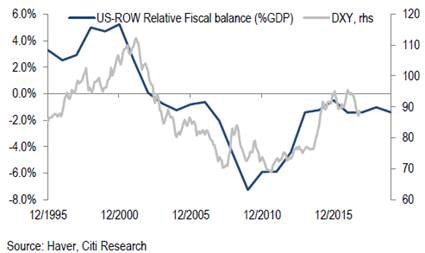

But what is also remarkable is that the improved environment for US interest rates hasn’t translated into USD strength.

One reason is US growth has come at a cost of a larger fiscal deficit. At the same time, global growth has been unusually sycnhronised, with a number of other economies showing even higher growth rates and with relatively cheaper equity market valuations when compared to the US. Our 2018 forecast for global growth is 3.4 percent.

Within this environment if the RBA remains on hold or increases more slowly than its US counterpart, US term deposits will eventually pay the same or higher rates, causing an outflow of funds from Australia.

But that doesn’t mean investors should chase US assets. We recommend clients hold US assets by sheer size of its market and our preference is to US tech specifically US financials that will do well in a rising rate environment. And we are recommend avoiding over-concentrating into the US alone.

Europe has seen steady improvement despite the twists and turns of Brexit and Italian politics. Its equity markets trade at a relative discount to the US market. Eventually the European Central Bank will taper its balance sheet and gradually raise rates, this should assist to underpin Euro strength. Recent US inspired trade tensions deserve watching, but that doesn’t make us less convicted at this stage.

Citi expects the USD to remain relatively weak in the medium term, unless there’s a flight to safety or restoration of the US fiscal position. However, given the case for robust global growth and a spendthrift US administration intent on making “America Great Again” a resurgent greenback is not our base case.

2) This chart illustrates the long-term and strongly correlated relationship between the USD and the US Fiscal Position as compared to the rest of the world. Strong fiscal positions (now a bygone era) used to mean US strength, now a deterioration of fiscal position anchors the USD despite the Feds increasing rates. DXY = Dollar Index (USD vs a basket of currencies).

Ultimately, what matters to Aussie investors is that “policy crossover” is a timely reminder of Australia’s tepid GDP growth and it’s not likely to shift gear any time soon or inspire investment and currency returns. Investors can consider more prospective international opportunities, this doesn’t just mean the US, but should also include Europe and Emerging Markets to diversify portfolios for more attractive returns in the long term, especially as Australia’s divergence in policy rate beckons.

Simson is an investment strategist for Citi Wealth Management

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions.