August 2018

Central Banks in Spotlight

By Paul Brennan

“With high levels of household debt, the RBA needs wages to pick up before it can start tightening monetary policy”

- Like other central banks the Reserve Bank of Australia faces some difficult choices. The economy is performing relatively well but inflation has been below the RBA’s target range of 2-3 per cent since mid-2014.

- The federal government’s National Energy Guarantee proposal and the recommendations from the ACCC’s inquiry into retail electricity pricing could see ongoing declines in electricity prices, further dampening inflation pressure.

- With the unemployment rate at 5.4 per cent, underlying inflation should be closer to 2.25 per cent but it has been tracking sidewards at 2 per cent for the past year.

- Like a number of its peers Australia is producing at below capacity with a productivity gap of -0.5 per cent. This reflects Australia being at an earlier stager in the current global economic upswing on account of the unwinding of the mining boom.

- There is ample spare capacity in the labour market. So unemployment needs to keep falling to trigger a sustained upward trend in wage inflation.

- Wages need to rise to justify a rate increase. Based on RBA forecasts on inflation and unemployment an initial rate tightening could occur mid-next year, although the risks are for it to occur later.

- In the US the probability of two additional rate hikes this year has gone up based on recent Federal Open Market Committee meetings, despite US President Donald Trump voicing his concerns on the matter and expressing his opinion that it should stop at 2.50%.

- While the Fed prepares further interest rate hikes, the European Central Bank (ECB) has indicated that it will not raise rates at least until next summer. Citi analysts believe that the ECB may be more comfortable hiking rates at the 12 September meeting next year when new staff macroeconomic projections will be available.

- In the UK, Citi’s call on an August rate hike remains on track as strong economic data so far is validating the Bank of England’s (BoE) forecasts. The main risk to Citi’s August hike call is political uncertainty surrounding the unity of UK Prime Minister Theresa May’s government.

- In Citi’s view, the Bank of Japan (BoJ) is unlikely to change its monetary policy stance at this week’s meeting as it has few options to ease policy and low inflation makes it difficult to pull off an increase in policy rates. However, the BoJ could set itself up for policy changes at upcoming meetings in September or October. Citi analysts expect the BoJ to maintain accommodative policy, which could limit the scope for yen appreciation.

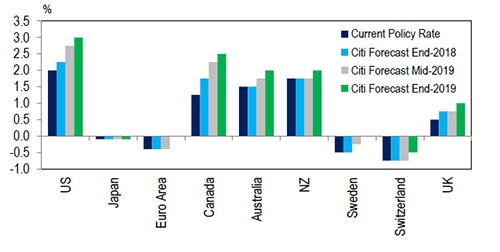

“Citi analysts continue to expect gradual tightening by some Developed Market central banks.”

Developed market policy rate forecasts

Source: Citi Research. As of 19 July 2018.

Implications

- In an environment where central banks are only gradually tightening monetary policy, Citi analysts believe that this is unlikely to derail the current nine-year bull market.

Paul is Chief Economist for Citi Australia

Disclaimer: This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions.