May 2018

A Bond for all Occasions

By Simson Sanaphay & Elsa Ouattara

We are transitioning from an ultra-low interest rate environment created by central banks to support growth to a setting where rates are no longer falling. Most developed market central banks have increased or intend to increase interest rates to remove stimulus.

Leading the charge is the United States, with a seventh rate increase from the Federal Reserve shortly anticipated, and more increases are predicted in this rate hike cycle. While locally our RBA has kept policy rates on hold, it will raise rates when economic conditions allow.

Its raises the question: do current market conditions warrant constructing or maintaining a bond portfolio. At Citi we give a resounding yes.

Bonds allow investors to address the issue of higher levels of volatility and the right type of bond can be an effective solution to both manage both portfolio market risk and concentration risk whilst generating attractive levels of consistent income.

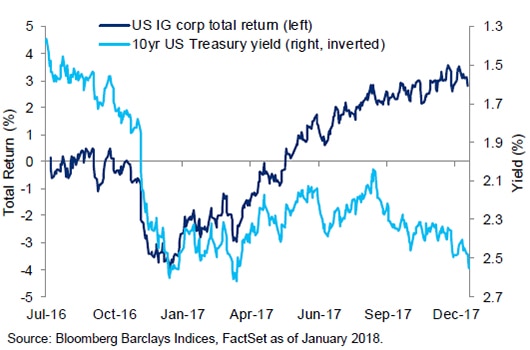

Broadly speaking, yields (long term interest rates) follow rates (shorter term rates). While US government bonds benefited from the historically secular bull market as rates reached generational lows, the recent rise in yields has had a negative effect on bond prices.

Typically, long-dated government bonds’ prices are the most sensitive to interest rates: US Treasuries, Japanese government bonds and European government bonds in particular, as they pay marginal returns.

While generally considered risk-free investments, investors are prone to reduce their allocations if they can attain higher yields from other investments.

Understandably, in this environment, many investors are steering clear of bonds altogether. But it’s important to remember that not all bonds are sensitive to interest rates rises to the same extent.

Choosing the right bond

As a rule of thumb: the level of bonds relates to the age of an investor. For example, if I’m 35 years old, then I should be holding roughly 35 per cent of my investment portfolio in bonds. The older I become, the greater the proportion of bonds in my portfolio.

Theoretically, when I retire I will hold a conservative portfolio, reflecting that my circumstances mean drawdowns are less tolerable and capital losses are harder to recover from.

This well-established guideline highlight that bonds serve a higher purpose than pursuing a pure growth objective or investing for dividends – as both can sometimes be accompanied by market volatility, particularly in aging bull markets.

Citi thinks the increasing number of issuances of investment-grade Australian dollar-denominated bonds by large multinational companies and United States dollar-denominated bonds are two compelling opportunities that will increase portfolio stability and allow investors to draw periodical incomes.

Australian dollar-denominated Investment Grade bonds from offshore financial institutions have shown resilience during the recent period of volatility, while offering attractive yield levels of up to 5 per cent. In addition, the US Bond Corporate Bond Index yield reached a high of 4 per cent - a return that is more rewarding than term deposits.

Investment-grade bonds are offering yields closer to high yield bonds but with significantly less risk of default. This means there is less risk for investors to lose their capital, and with half the correlation to equity markets.

Citi’s Strategists observe a 44 per cent correlation to global equity markets in Investment Grade corporate paper, when compared with a 78 per cent correlation from high yield Corporate Bonds.

This represents a great opportunity for investors to consider using high quality, high-yield corporate bonds as a way to barbell their equity exposure as part of their portfolio allocations. We see the business cycle as increasingly mature - the ‘goldilocks’ environment of steady growth and low inflation cannot last forever.

Whilst an investor’s equity investments have higher levels of market risk but can present growth, bond investments are a complementary piece of the puzzle. Not only do they generate income, but when taken together, investors can capitalise on lower portfolio risk and volatility through asset class diversification and lower levels of market correlation.

With market expectations of corporate tax cuts, strong earnings growth, synchronised global growth and some equity valuations becoming stretched, it’s important that investors protect their capital gains. We know that bonds will have risks, but it’s just as important to remember that not all bonds are created equal.

In the same way that equity investors consider the differences between growth stocks, dividend yielding stocks, cyclical stocks and defensive stocks, bond investors should apply a likeminded sense of differentiation. Not all bonds are the same, and they are an essential component of a well-balanced investment portfolio.

Simson is an investment strategist for Citi’s wealth business.

Elsa is a fixed income specialist for Citi’s wealth business.

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL No. 238098, Australian credit licence 238098. Any advice is general advice only. It was prepared without taking into account your objectives, financial situation, or needs. Before acting on this advice you should consider if it's appropriate for your particular circumstances. You should also obtain and consider the relevant Product Disclosure Statement and terms and conditions before you make a decision about any financial product, and consider if it’s suitable for your objectives, financial situation, or needs. Investors are advised to obtain independent legal, financial, and taxation advice prior to investing. Past performance is not an indicator of future performance. Investment products are not available to US people and may not be available in all jurisdictions.